Hydrogen in the Reformed EU ETS

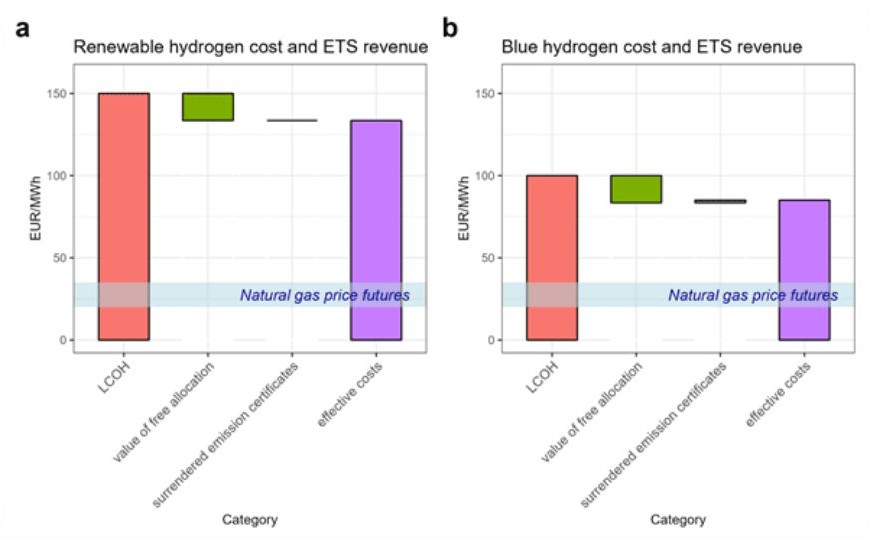

Figure: Comparing green (left) and blue hydrogen (right) costs accounting for EU ETS impacts (assumed CO2 price: 80 €/tCO2) based on the optimistic end of near-term cost estimates for 2025 to 2030. The value of free allocations is calculated based on CBAM factor of 100 %, which applies until the end of 2025. No additional subsidies considered here.

Hydrogen in the Reformed EU ETS: What It Means for Competitiveness and Emissions Reductions?

🔹 Key insights:

📌 The EU ETS alone cannot make hydrogen competitive.

- Hydrogen production (both renewable and blue) remains significantly more expensive than natural gas — currently 4 to 6 times more costly.

- The value of freely allocated ETS allowances does little to close this gap, as illustrated in the picture below with the green part, especially with today’s relatively low CO₂ prices.

📌 To bridge the cost gap and enable a fuel switch from natural gas to low-carbon or renewable hydrogen, CO₂ prices of €300–500/tCO₂ would be necessary.

📌 Switching from blue to green hydrogen would require €2500/tCO₂ if only downstream emissions are priced.

✅ Policy recommendations include:

📌 Expanding the EU ETS to cover upstream emissions for a more accurate climate cost signal.

📌 Gradually lowering the emission intensity threshold (currently 28.2 gCO₂eq/MJ) for low-carbon hydrogen to encourage innovation and deeper decarbonisation.

💡 To use hydrogen for the energy transition, it is essential to go beyond emissions pricing and rethink how to support its competitiveness and climate impact.