IEA World Energy Investment 2025 Report

Figure: Investment in selected low-emissions fuels in selected regions, 2023, 2024 and 2025

Source: World Energy Investment 2025 report, 10th Edition

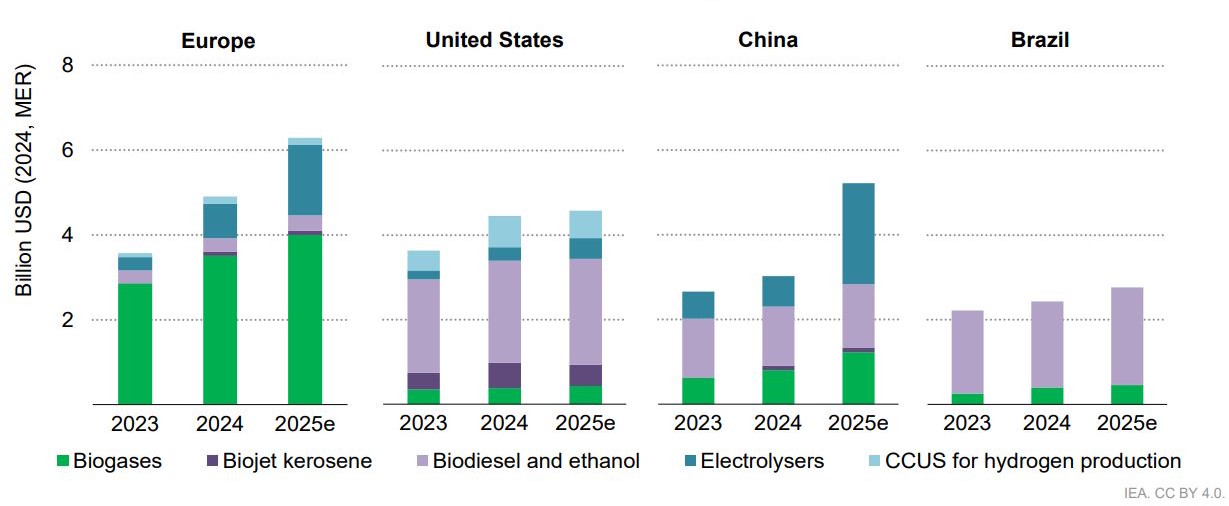

Investment in liquid biofuels, biogases and hydrogen is set to rise by 30 % in 2025, to nearly $25 billion, building on a 20 % rise in 2024.

📌 Low-emissions fuel spending varies greatly by region:

- in 2024, Europe accounted for 60% of global investment in biogases;

- the US made up 70% of global investment in biojet kerosene;

- China has large investments in hydrogen;

- Brazil focuses on liquid biofuels.

📌 Investment in liquid biofuels, biogases and low-emissions hydrogen is set to rise by 30% in 2025 to a record high close to USD 25 billion, building on a 20% rise in 2024.

📌 Policies and regulations remain essential to this growth: mandates, quotas and other forms of policy support have underpinned the high levels of investment in biodiesel and ethanol in the United States and Brazil and in biogases in Europe.

📌 Some hydrogen projects have been cancelled or delayed in the past 12 months, but there remains a pipeline of projects that have received FID, requiring around USD 8 billion of investment in 2025, a 70% increase from the level in 2024.

📌 For hydrogen:

- there were a number of setbacks for projects around the world, nonetheless, investment rose by 60% in 2024, and there remains a large pipeline of hydrogen production projects that have received FID.

- government support has continued in 2025 globally, for example, in Australia and the EU.

- all hydrogen projects that have received FID would require investment almost USD 8 billion and would increase capacity to around 7.5 Mt in 2035.

➡️ Source: World Energy Investment 2025 report, 10th Edition