Mapping the cost competitiveness of African green hydrogen imports to Europe

Figure: Overview of African green hydrogen projects by country and end use

Source: Mapping the cost competitiveness of African green hydrogen imports to Europe

📃 Article “Mapping the cost competitiveness of African green hydrogen imports to Europe” was published by researchers of the Technical University of Munich (TUM), the University of Oxford and ETH Zurich.

✅ The Key Findings:

📌The research covers:

- all projects planned to be operational by 2030.

- the analysis of African countries with port access.

- 31 countries, except Somalia and Libya, were excluded due to political instability and small island states.

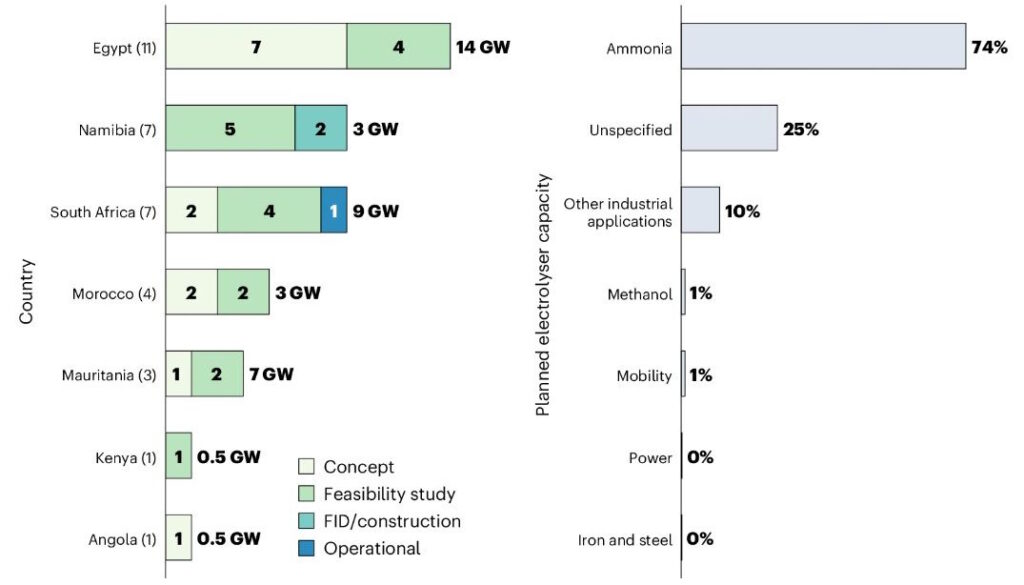

📌 Overview of African green hydrogen projects:

- 34 projects are found across 7 countries;

- 89% of projects are either at concept or feasibility stages;

- 2 of the projects have reached a financial investment decision and are under construction, and only one small-scale project (that is, 3.5 MW) in South Africa is operational;

- From 3.5 MW to 6.9 GW is planned project sizes;

- 74% of planned electrolyser capacity is intended for ammonia (NH3) production

📌 Levelized cost of hydrogen (LCOH):

- In a high interest scenarios 1 and 2, least costs for green H2 exported from Africa are €4.9 kgH2−1 without policy support and €3.8 kgH2−1 when fully de-risked by European governments.

- In a low interest scenarios, the costs come down to €4.2 kgH2−1 and €3.2 kgH2−1, respectively.

- no location competitive with the first round of auction results by the European Hydrogen Bank, which yielded a lowest bid of €2.8 kgH2−1 in Spain.

📌 Challenges:

- many low-cost locations are in regions that are either politically contested or encounter relatively regular flares of armed conflict.

- the size of the planned investments relative to the GDP raises questions on feasibility. This situation is concerning as many African countries face massive foreign debt burdens.

- whereas wind resources are critical to low-cost green H2 production, local expertise to install this wind capacity may be insufficient.

- some low-cost locations, such as those near the Red Sea or the river Nile in Egypt, may also face challenges of water insecurity potentially disrupting consistent production.