National Hydrogen Strategy in France

On April 10, 2025, the Government of France announced the update of the National Hydrogen Strategy.

📃 The full text of the updated strategy is available via this link.

✅ Key Changes and Measures:

📌 Electrolysis installation targets in the region with up to 4.5 GW targeted for 2030 and 8 GW installed in 2035;

📌 Mastery of all hydrogen equipment and technologies throughout the value chain;

📌 The deployment in France of low-carbon hydrogen transport infrastructures within hydrogen hubs;

📌 Ensuring that the necessary framework conditions are in place for the development of the French hydrogen industry, particularly in terms of access to land, procedural deadlines, the development of a comprehensive, clear and stable regulatory framework, and electrical connections;

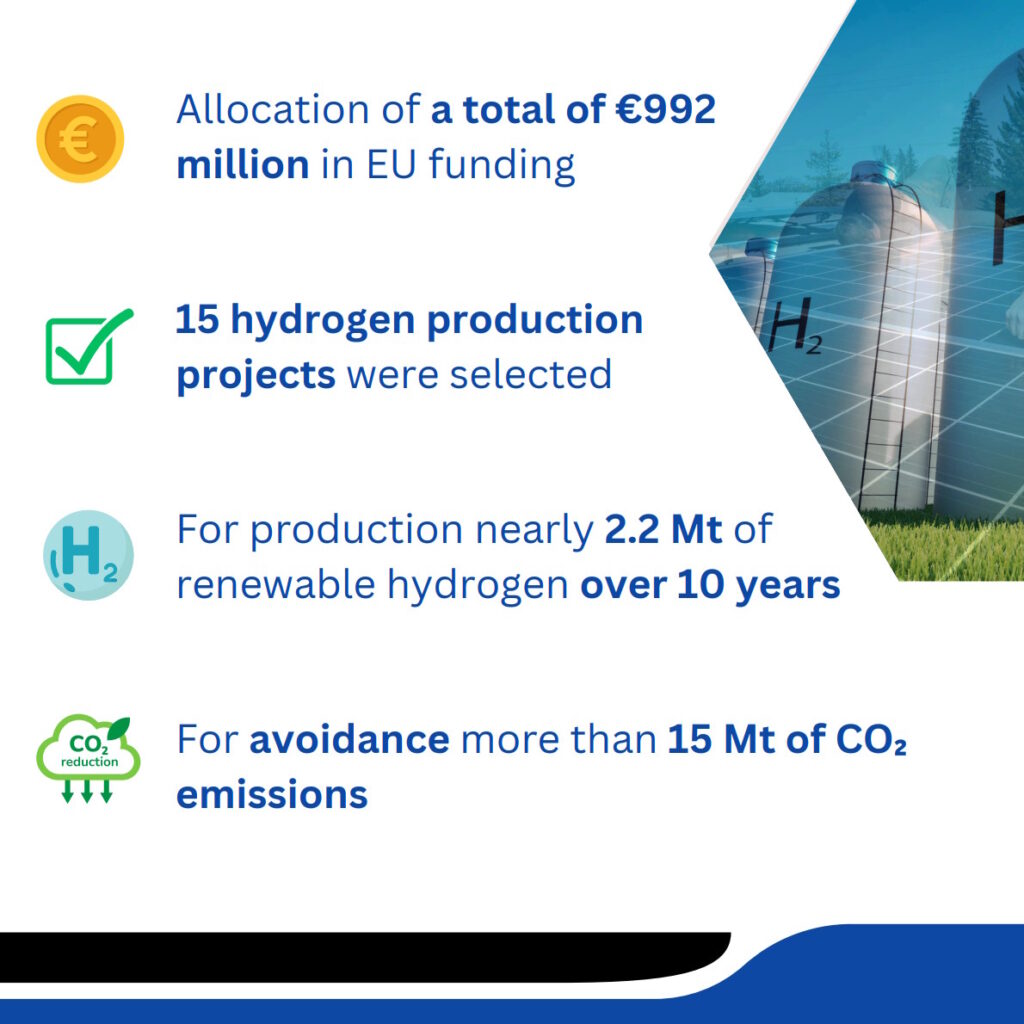

📌 A €4 billion support mechanism for low-carbon hydrogen production to ensure that low-carbon hydrogen is competitive with fossil hydrogen over 15 years;

📌 The relaunch of the ‘IDH2 Hydrogen Technology Building Blocks’ call for projects, designed to support the development of certain critical elements of hydrogen technologies;

📌 A new call for projects for the deployment of hydrogen-powered commercial vehicles, to enable the technological development of fuel cells and tanks;

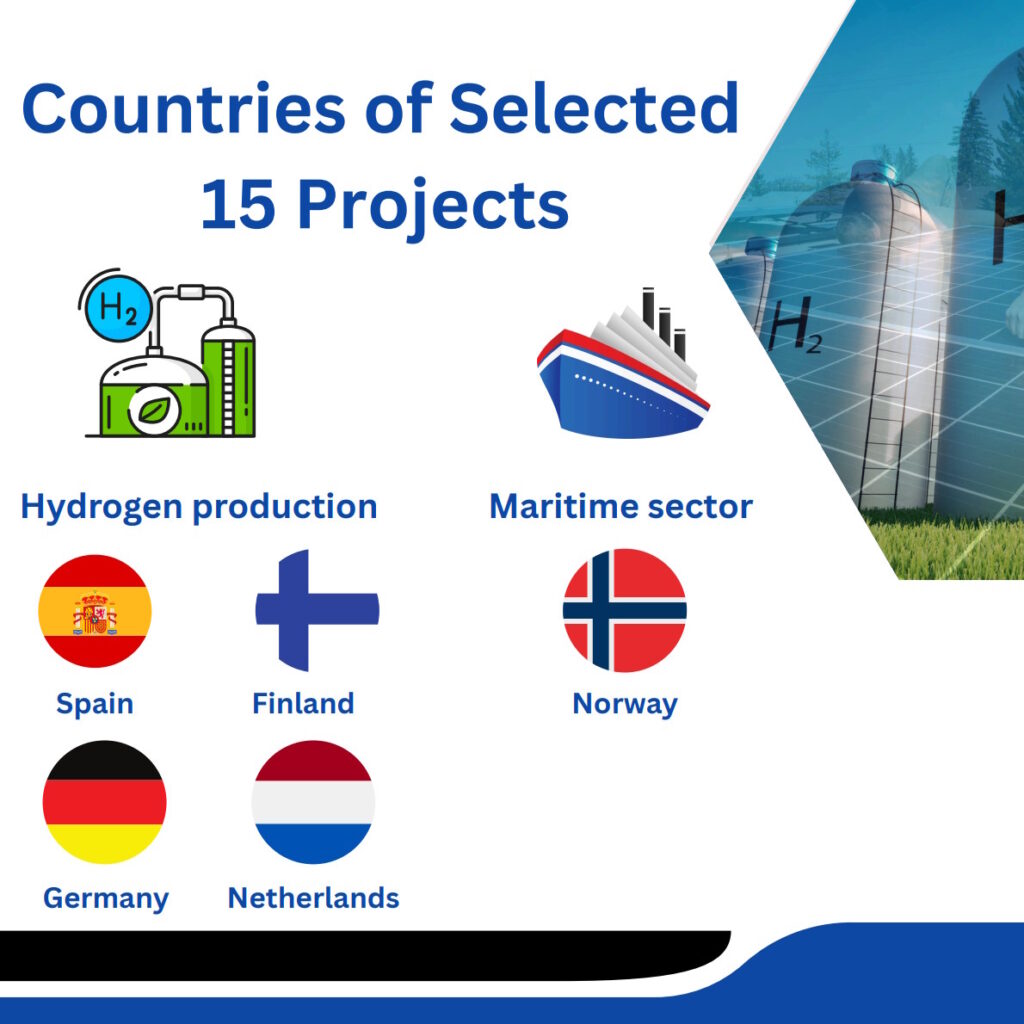

📌 Measures to support studies of synthetic fuel projects in order to bring about, by 2030, the first industrial production of synthetic fuels for aviation and maritime sectors.

➡️ Source: Le Gouvernement actualise la Stratégie nationale de l’hydrogène décarboné