Lobbying activity in the EU hydrogen sector

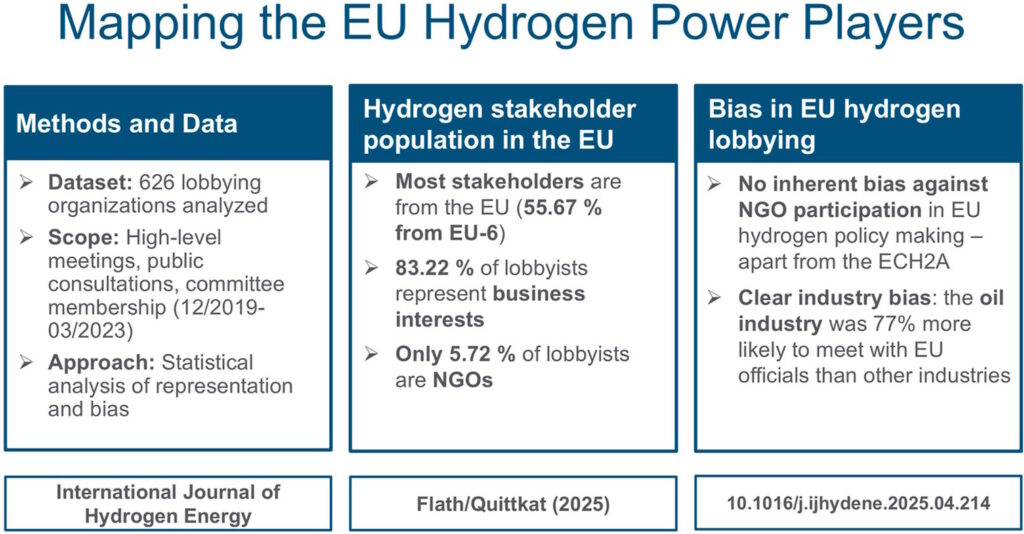

Figure: Mapping the hydrogen power players

Source: Article “Mapping the hydrogen power players: An analysis of lobbying on EU hydrogen policy-making”

Article “Mapping the hydrogen power players: An analysis of lobbying on EU hydrogen policy-making” Lucas Flath, Christine Quittkat provides:

- First analysis of hydrogen lobbying processes in EU policy-making.

- First mapping of hydrogen lobbyists at EU-level.

✅ Some takeaways:

📌 The actual depth of the hydrogen economy will result not only from technological competition, but also from political decisions – for Europe, in particular, EU regulations and policies.

📌 It can be expected that the integration of hydrogen into the energy system will be a highly politicized process, with various actors trying to influence the transition in their own interests, as has been observed in other fields of the energy transition.

📌 European business lobbying often takes place through and by associations, which have established channels of access to political decision-makers. The European Commission, in particular, favors associations as contact partners because an aggregation of individual actors reduces the transaction costs of coordination.

📌 Corporate lobbying in the EU traditionally takes place through a multi-level chain of representation: Companies join national trade associations, which in turn are members of the corresponding associations at EU level. However in recent years, direct lobbying by individual companies at EU level has increased significantly.

📌 The membership structure of European hydrogen associations shows that hydrogen is supported by a wide range of economic sectors and actors, but in particular by mid- and downstream natural gas companies, large chemical companies, car manufacturers, and manufacturers of machinery, electronic and electrical equipment.

📌 The most well-known key factors influencing lobbying activity are material resources, such as lobbying budget or lobbying staff. Organizations with greater resources, regardless of other characteristics, are more likely to gain access to European decision makers.

📌 Characteristics of the hydrogen stakeholder population:

- 47.28 % – companies

- 35.94 % – trade associations

- 5.72 % – NGOs

📌 Geographical distribution of hydrogen stakeholders:

- Most of the stakeholders (467; 74.60 %) are primarily organized at the national level.

- 139 actors (22.20 %) are primarily organized at the EU level and a small portion of 20 actors (3.20 %) represents interests organized at the international level.

- Among the stakeholders organized at the national level, 410 (87.79 %) are based in EU Member States.

- The most frequently represented non-EU countries are the United States, the United Kingdom, Norway and Switzerland. Germany is best represented with 166 actors (24.84 % of the total).