Pacific Northwest Low-Carbon Hydrogen Analysis

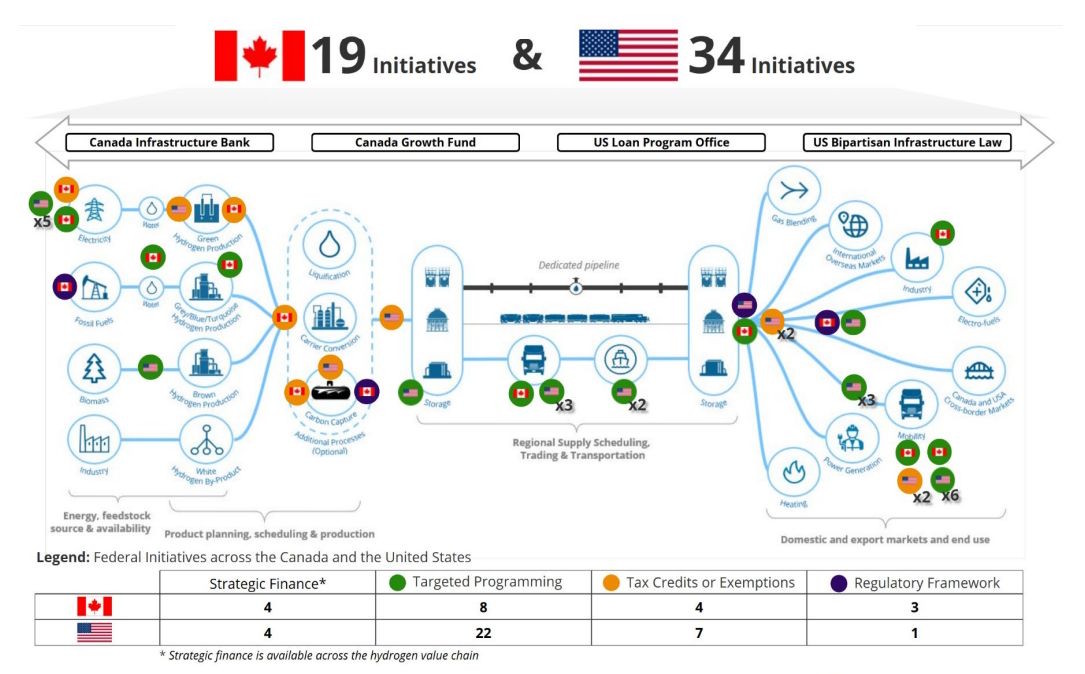

Figure: Canada and United States support initiatives and value chain applicability

Source: New report: Pacific Northwest Low-Carbon Hydrogen Analysis

Pacific Northwest Low-Carbon Hydrogen Analysis, published by The Pacific Northwest Economic Region (PNWER), provides a comprehensive view of supply, demand and trade opportunities for low-carbon hydrogen between the US and Canada.

✅ Some takeaways

📌 Canada:

- has a total of 19 direct or indirect support programs available to accelerate the development and deployment of hydrogen technologies and industry across the value chain.

- Tax measures such as the Clean Hydrogen Investment Tax Credit (ITC), Clean Technology ITC, Clean Technology Manufacturing ITC, and the Carbon Capture, Utilization and Storage (CCUS) ITC are complemented by funding programs such as the Clean Fuels Fund and Strategic Innovation Fund – Net-Zero Accelerator.

📌 The US:

- has a total of 34 direct or indirect federal programs and initiatives across multiple national departments and agencies, which enable the use of hydrogen across the value chain.

- The US Renewable Fuel Standard (RFS) mandates the blending of renewable fuels into the supply of transportation fuels, with an aim at reducing overall GHG emissions from the sector. While the RFS primarily focuses on biofuels, it also includes provisions for hydrogen derived from renewable feedstocks, like biomass, which generates an economic incentive for the transportation sector to include low-carbon hydrogen in its pathways to decarbonization.

➡️ Source: New report: Pacific Northwest Low-Carbon Hydrogen Analysis