Bringing Hydrogen to the EU Market

In this episode of Clean Energy Talks video blog with Joris Vlasblom, an experienced energy advisor specializing in hydrogen, renewable energy, and Sustainable Aviation Fuel (SAF), we talk about bringing hydrogen to the EU Market:

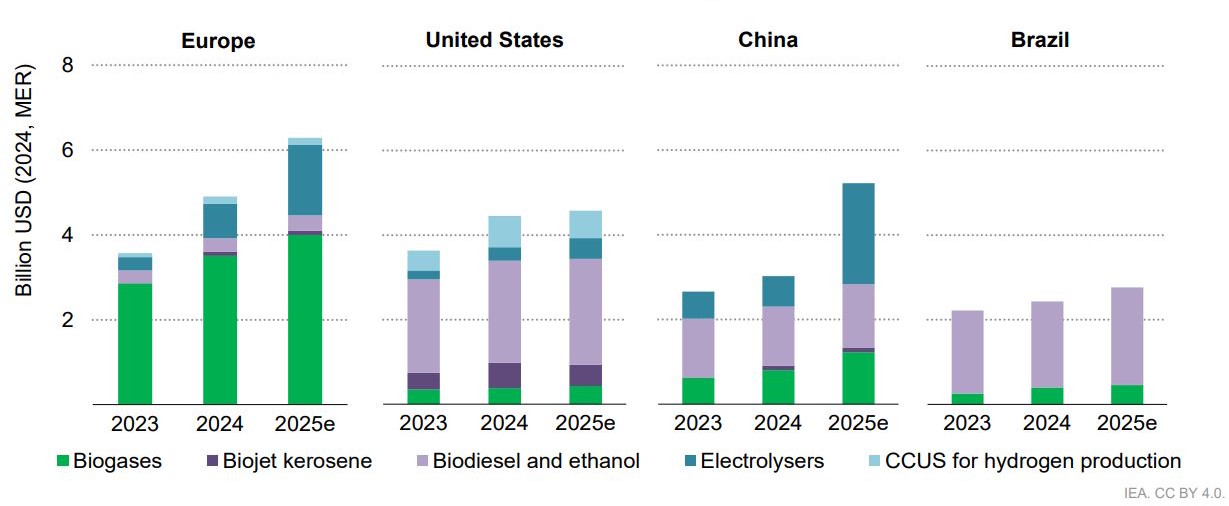

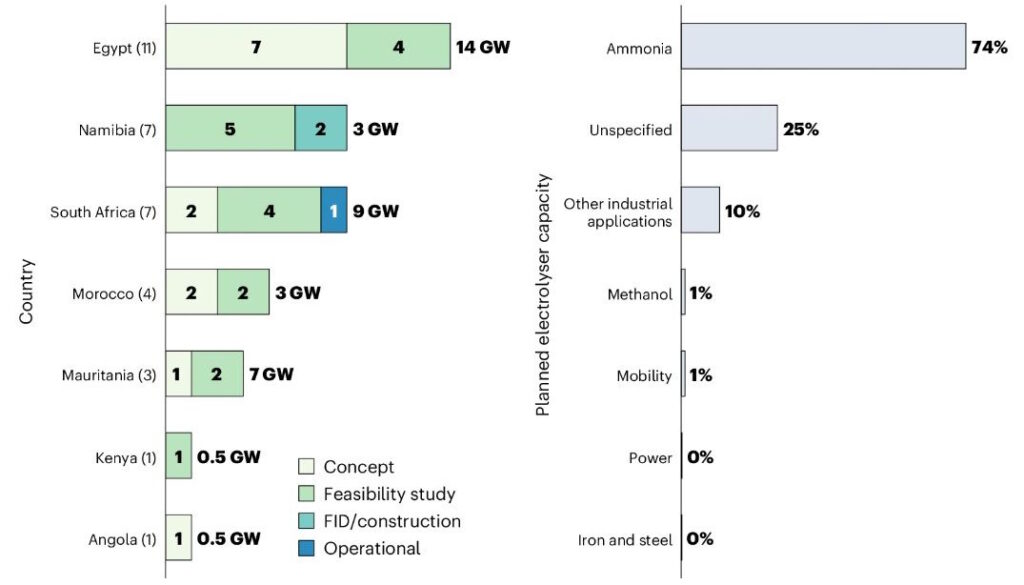

I. EU Hydrogen Targets & Demand

How do you assess the current demand for hydrogen and its derivatives in the EU?

How aligned is the current market demand with the EU’s hydrogen targets for 2030 and beyond?

II. Market Entry & Readiness

What are the biggest challenges to bringing hydrogen into the EU market today?

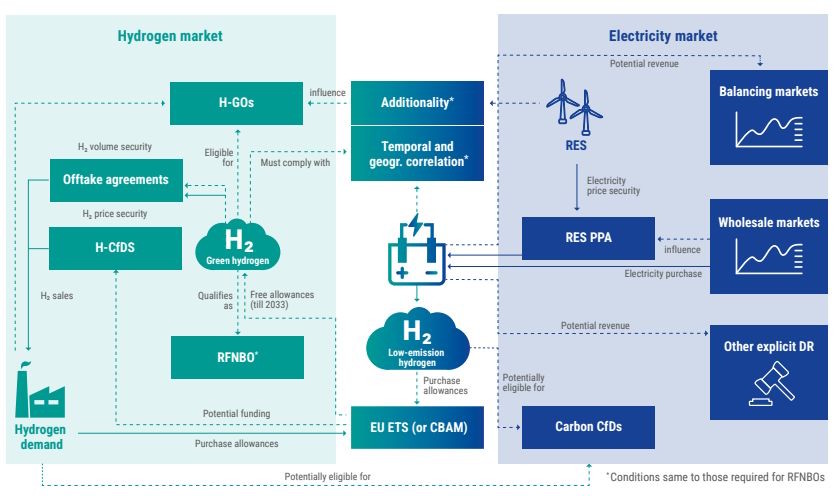

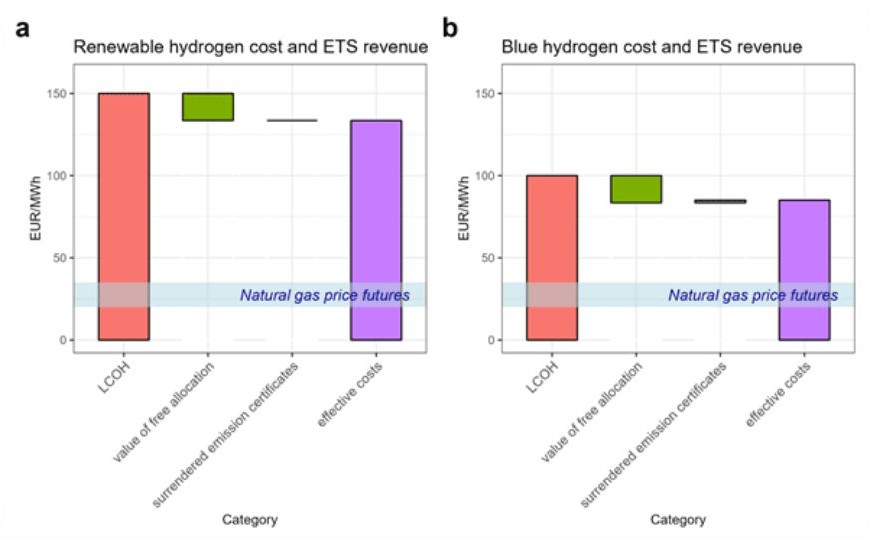

III. Certifications & Standards

How can producers confirm the compliance of hydrogen with EU market requirements?

How crucial is the RFNBO certification for accessing the EU market?

IV. Infrastructure & Technology

What infrastructure gaps (e.g. ports, pipelines, storage) are most urgent to address?

V. Practical Solutions

What are some practical steps companies should take when planning to enter the EU hydrogen market?

➡️ Reach out here on LinkedIn or contact me for more details on the video topic.