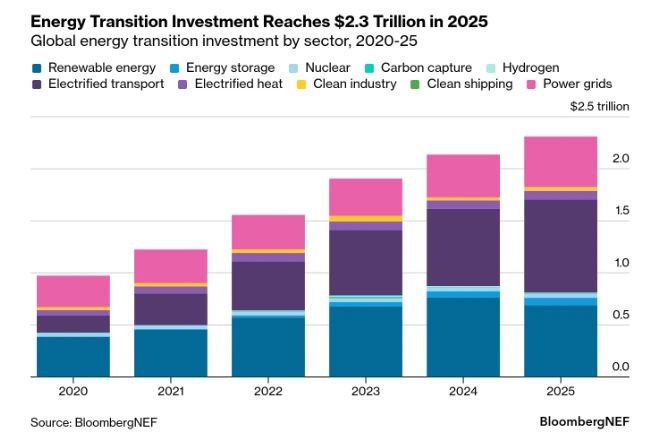

The Energy Transition Investment Trends Report

Figure: Global energy transition investment by sector, 2020-2025

Source: BloombergNEF

The Energy Transition Investment Trends (ETIT) Report, released by BloombergNEF (BNEF), finds that global investment in the energy transition reached a record $2.3 trillion in 2025, up 8% from the prior year.

✅ Main Takeaways:

📌 The largest investment drivers were:

- electrified transport – $893 billion;

- renewable energy – $690 billion;

- grid investment – $483 billion.

📌 Renewable energy investment fell 9.5% year-on-year due to changing power market regulations in China.

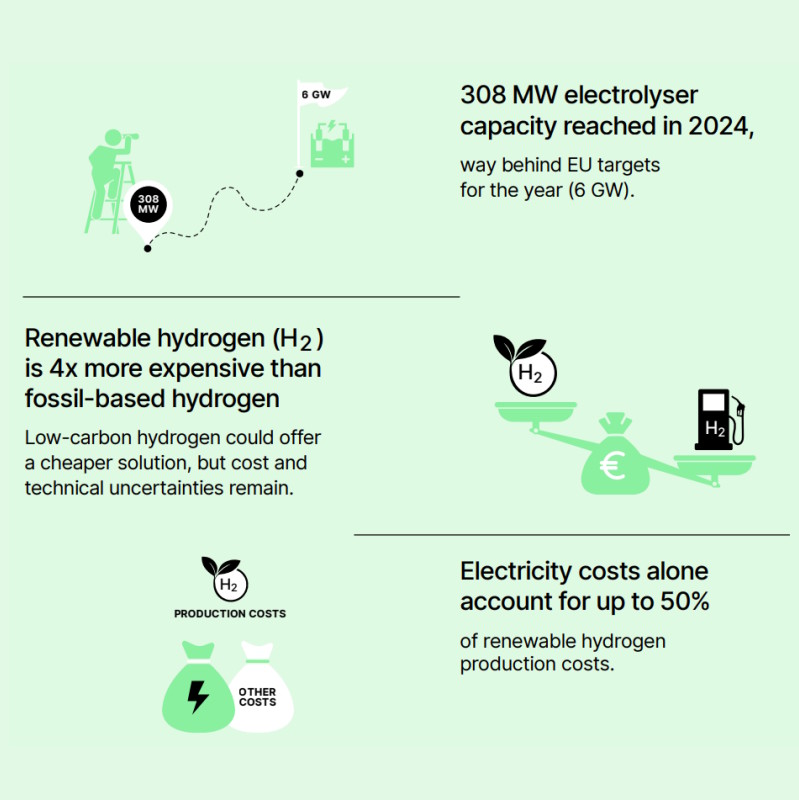

📌 Hydrogen ($7.3 billon) and nuclear ($36 billion) saw investment drop in 2025. All other sectors grew: energy storage ($71 billion), CCS ($6.6 billion), clean shipping ($4.2 billion), electrified heat ($84 billion) and clean industry ($34 billion).

📌 Clean energy supply investment outpaced fossil fuel supply for a second consecutive year in 2025, with the gap widening to $102 billion from $85 billion in 2024.

📌 While clean energy investment continued to grow, fossil fuel supply investment fell for the first time since 2020, declining by $9 billion year-on-year.

📌 Despite energy transition investment being at an all-time high, growth has slowed steadily, from 27% in 2021 to 8% in 2025.

📌 The regional changes:

- China ($800 billion) is posting its first decline in investment since 2013.

- The EU shrugged off headwinds to grow 18% to $455 billion, contributing the most to the global uptick.

- US investment also moved up 3.5% to $378 billion, despite the Trump administration’s moves to slow the energy transition.