IEA Global Hydrogen Review 2025

The hydrogen sector is growing despite persistent barriers and project delays.

✅ Key Takeaways from the IEA Global Hydrogen Review 2025:

1️⃣ Global demand continues to rise

- Hydrogen demand reached 100 Mt in 2024, up 2% from 2023.

- Fossil fuels still dominate supply: 290 bcm natural gas and 90 Mtce coal equivalent.

- Low-emissions hydrogen grew 10% in 2024, but remains <1% of total production.

2️⃣ Project delays and cancellations

- Uptake of low-emissions hydrogen lags behind ambitions due to high costs, regulatory uncertainty, and slow infrastructure development.

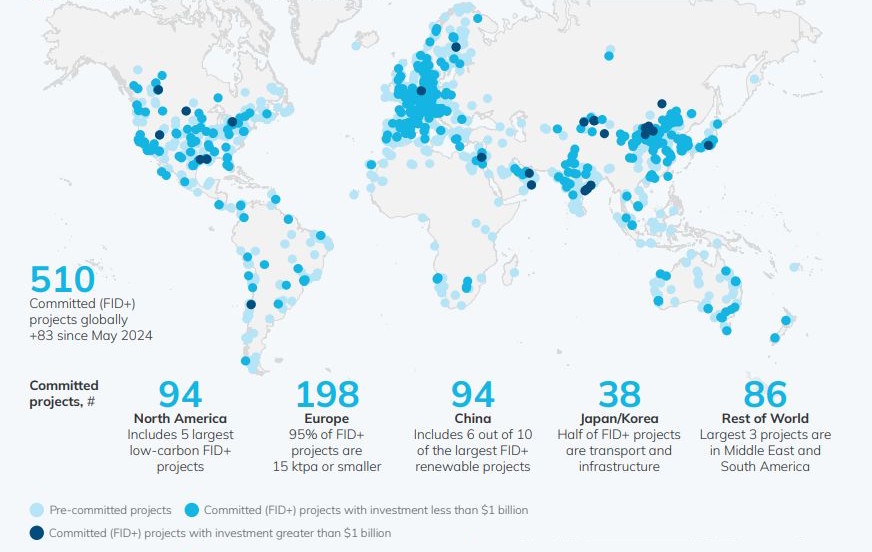

- The sector shows signs of maturity: 200+ low-emissions projects received FIDs since 2020, up from just a few demonstration projects.

- Innovation across the value chain is strong.

3️⃣ Production outlook to 2030

- Announced low-emissions projects have decreased from 49 Mtpa to 37 Mtpa due to delays and cancellations, mainly in electrolysis.

- However, operational projects and projects reached FIDs could deliver 4.2 Mtpa by 2030, a fivefold increase from 2024.

- An additional 6 Mtpa could come online by 2030 if effective policies and offtake mechanisms are implemented.

4️⃣ Costs and competitiveness

- The cost gap between low-emissions hydrogen and fossil-based production remains a challenge, though expected to narrow by 2030.

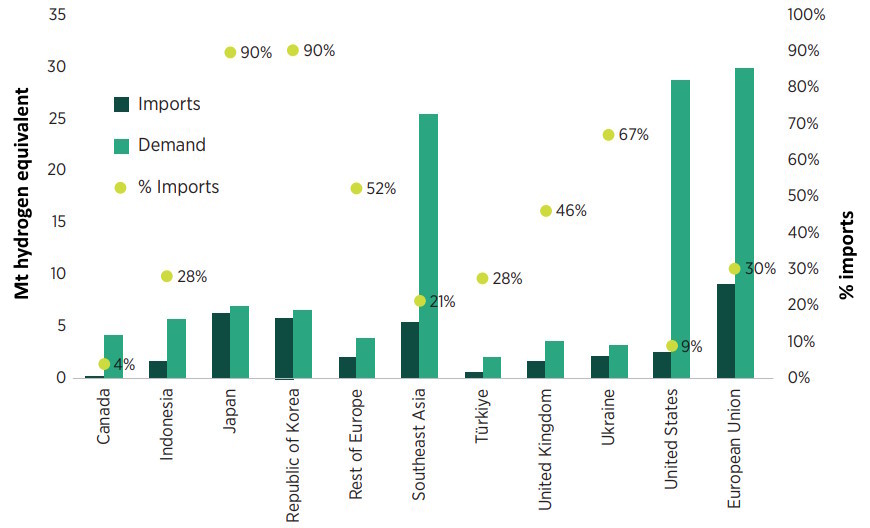

- China and Europe could see cost-competitive renewable hydrogen.

- In the US and Middle East, CCUS for producing low-emissions hydrogen may remain more competitive in the near term.

5️⃣ Policy and demand signals

- Momentum for hydrogen offtake agreements slowed in 2024: 1.7 Mtpa signed vs. 2.4 Mtpa in 2023.

- Most agreements remain in refining, chemicals, shipping, and some aviation.

- Policies to create demand are progressing but full impact will depend on implementation.

Figure: Global Hydrogen Review Summary Progress

➡️ Source: Global Hydrogen Review 2025